ESG for Consumers, Customers & Fans

One stakeholder – the consumer – is a central driver of sustainability. Consumers’ sustainability-focused behaviors drive the market for sustainable products and services, leading to sustainable firm and investor behavior.

Social and environmental performance is critical even in an economy with rising cost of living. Now more than ever, if brands want to retain and win consumers, they must stand for something.

Mike Johnston, Managing Director Data Products, Glow

Americans really love to shop.

According to the World Bank, the 2021 final (household) consumption expenditure total for the entire planet was $69.95 trillion. The United States’ share of that? A massive $19.26 trillion – 28 percent, almost one-third of the total.

The World Bank defines final consumption expenditure as “… the market value of all goods and services, including durable products (such as cars, washing machines, and home computers) purchased by households. It excludes purchases of dwellings but includes imputed rent for owner-occupied dwellings.” This is the World Bank’s fancy way of saying that Americans spend way more on stuff and services than basically any nation on the planet and double what the nearest contender spends – China at $9.61 trillion (14 percent).

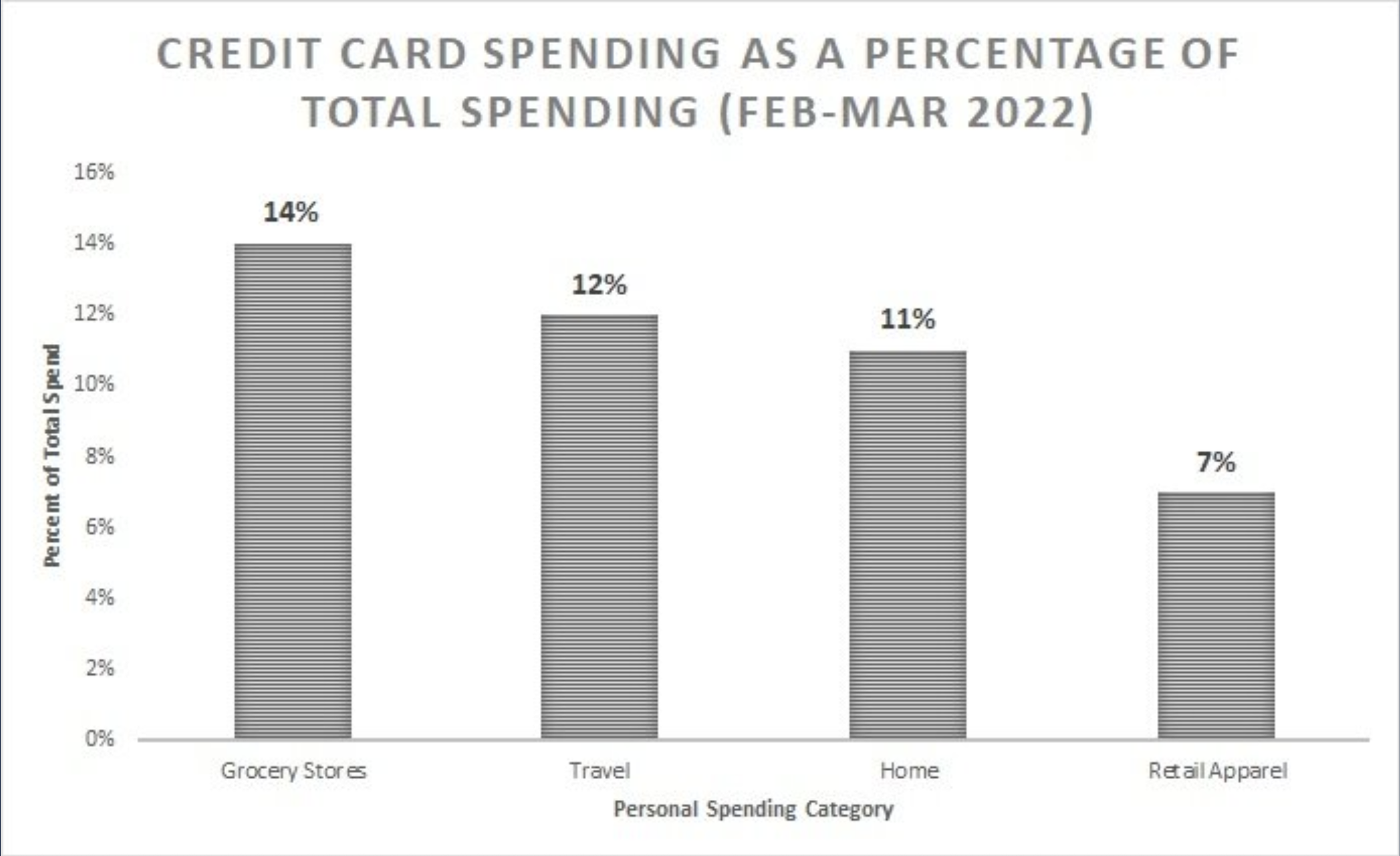

In short, when we spend, we spend big. No wonder politicians and U.S. presidents (like President George W. Bush post-9/11) urge us to shop ‘til we drop. It keeps our economy humming. Feeling good now that lockdowns are lifted, Americans across all age cohorts and income levels began opening their wallets whether using savings or loading up credit cards. U.S. consumers spent 18 percent more than two years before and 12 percent more than forecasted.

But specifically, what are Americans spending money on? And how does ESG impact any of that, if at all? Here, I focus on the top expense area for U.S. shoppers – grocery stores and consumer packaged goods (CPGs).

(Alldredge et Al., “How US consumers are feeling, shopping, and spending - and what it means for companies”)

Consumers use consumer packaged goods (CPG) routinely, and those require routine replacement – items like food, beverages, clothes, tobacco, makeup and household products. The $2 trillion CPG industry is highly competitive, and product manufacturers like Coca-Cola, Procter & Gamble and L’Oréal constantly battle for prime real estate on grocery store shelves. Employing millions of people and making trillions of dollars, CPG manufacturers must also spend big advertising dollars to keep their products foremost in consumers’ minds.

With the pandemic in the rearview mirror and inflation on the horizon, consumers said they were brand-switching from familiar brands for one primary reason – value. Post-pandemic, people noticed rising food and gas prices more than any other spending category, and more than one-third say that they switched to private-label products.

A 2022 Consumer Pulse survey showed that brand purpose was less important to consumers but novelty was the (literal) new, shiny thing. Also, omnichannel shopping became the new normal with 75 percent of consumers researching both in-store and online purchases, and that includes food. This new shopping mode has the biggest fan base with younger-age cohorts, and social media cues and prompts impress these groups.

Grocery ESG - Money talks, and bulls_t walks

Given consumer skittishness about inflation, especially with food and gas, ESG seems like it would be ancillary at best to most grocery shoppers and repellent at worst. Yet when people are asked about their preferences for sustainable and ESG-impact products and services, 78 percent say that a sustainable lifestyle is “important” to them. Another 60 percent say they’d pay more for a product with sustainable packaging.

With CPG manufacturers, for example, it’s expensive to make and market ESG-related products, and manufacturers say they have a hard time generating demand for them. So what gives? Are peoples’ self-reported good intentions resulting in action, or inaction? Or are manufacturers misreading or miscommunicating with their customers?

The issue needs slicing and dicing because different age cohorts report differing needs and wants with ESG. More than two-thirds of younger-age cohorts say at least one ESG aspect is “very important” to them, and top of their list is companies that are transparent and treat employees well. One word routinely comes up with Gen Z and Millennials – authenticity – and younger cohorts prioritize social (S) issues like workplace gender equality and inclusivity. Coupled with social issues like DEI, younger cohorts say that a company’s authenticity drives or repels their buying behavior, while older adults prioritize health and environment.

The Business Case

In 2023, NielsenIQ and McKinsey & Company tracked over 600,000 individual SKUs across 44,000 brands of food, beverages, household and personal-care items to see if there were different growth rates for ESG- and non-ESG-labeled products.

In short, the study showed that there is a material, clear and wide link between ESG-related claims and consumer uptake, though the findings are more nuanced at the product level.

There were also some more nuanced findings that show clear market signals for ESG-labeled products over non-labeled twins:

• Biggie Smalls - Both large and small brands with ESG labeling showed bigger growth rates, with the smaller brands achieving the largest amount (59 percent) and larger brands with 50 percent. (Perhaps they had more room to grow to maturity.) Midsize companies underperformed here, perhaps because they’re caught in the middle without the massive budgets of larger brands and the air of authenticity (that aura younger cohorts love) that comes from smaller ones.

• Private Label – ESG-labeled products achieved higher growth rates across all pricing tiers, and this holds true for private-label products with ESG. In 88 percent of categories, private-label products with ESG outperform conventional peers, suggesting that even value-focused shoppers want values-driven products and are a potentially big market for private label. (Remember the values-to-value investment spectrum in chapter TK on investment?)

• How common? – ESG claims that are less common (like vegan or zero-carbon) track with the highest growth rates, and they grew 8.5 percent more than products without those labels. Medium-prevalence claims (like sustainable packaging or plant-based) showed a 4.7 percent differentiated growth. And the most common (like environmentally sustainable) had the smallest difference. Still, all these showed at least a 2 percent higher growth versus those without any ESG labeling.

• More is more – With ESG labeling, some is good, but more is better. When products bear multiple ESG labels, there’s a positive correlation between number of distinct ESG claims and growth rates across almost 80 percent of categories. ESG products appear to do better when they’re plastered like NASCAR drivers, and even displaying two ESG labels versus one can double growth rates.

In no way am I suggesting that anyone paste a product over with labels and certifications randomly or untruthfully. ESG claims need to be true and more importantly, resonant with an audience. That said, when companies ESG-label and -certify products richly and rightly, the data shows it’s a winning strategy. This is especially true in the biggest category of U.S. consumer spending – what people are spending in grocery stores and especially on CPGs.